10 Days Later: Is Figma Worth the Price?

A SaaS 2.0 artifact priced as if it already controls the AI futur.

Just ten days ago, Figma went public under the ticker “FIG”. It ended its first day of trading at levels that generated the largest pop for any public listing since at least 2018 (+250%!). However, Figma's share price has since fallen sharply from that peak, settling at around $40 billion - still a valuation that would make even the bench of elite SaaS companies take notice.

Given the scarcity of IPOs, particularly in high-growth SaaS companies, institutional investors were initially willing to pay multiples comparable to those of elite companies like ServiceNow, Datadog, or Snowflake. The first day saw extraordinary price action by any standard. Now, past the initial trading frenzy, the question becomes whether Figma justifies its current price - one that implies a ~35x forward revenue multiple, slightly less than half that of Palantir (~73x NTM revenue), and (very) largely above that of all other software companies.

Within a week of Figma's S-1 filing on July 1, 2025, I published the research we produced for our subscribers. Our Durable Growth MoatTM analysis assigned Figma a composite score of 3.43 out of 5, reflecting moderate to high confidence in the company's ability to sustain durable growth through the agentic era transition. This score acknowledged exceptional current performance while being tempered by material uncertainties to future durability.

Now seems the right moment to share some extracts around what I think were the critical considerations for understanding the company's moat strength and appropriate valuation.

Understanding Figma Through the Durable Growth Moat Lens

The Durable Growth MoatTM framework evaluates companies across two dimensions that have become essential in the age of AI: Financial Adaptability and Architectural Resilience. Financial Adaptability examines the quality of revenue, growth, margins, and balance sheet strength, the traditional markers of business excellence. Architectural Resilience assesses how well-positioned a company is for the transition to agentic AI, examining both vulnerabilities to disruption and opportunities to capture new value. This dual lens recognizes that operational excellence alone no longer guarantees future value creation.

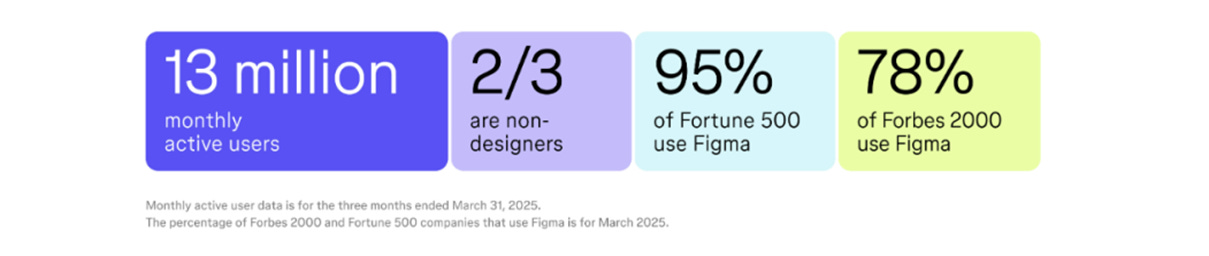

"Figma is where teams come together to turn ideas into the world's best digital products and experiences," reads the company's first page on its S-1. Initially a design tool, the company has evolved into a comprehensive product suite well beyond the design function, aiming to become a "product OS" for its customers. The launch of Dev Mode in 2023 signaled this platform ambition, though the S-1 remains silent on its contribution to ARR and growth. The company boasts 13 million monthly active users.

Figma represents one of the most successful product-led growth stories within enterprise software over the past decade. Its journey to public markets was catalyzed by the collapse of its $20bn acquisition by Adobe - a deal that effectively set a floor for the IPO price. When announced in September 2022, Figma was tracking toward $400 million in ARR with net dollar retention exceeding 150%. The deal's regulatory failure and the resulting $1bn termination fee provided a massive, non-dilutive capital injection that fueled a 4.5x increase in R&D spending in 2024, with approximately 40% directed at AI.

The Power of Product-Led Growth

The company employs a powerful hybrid go-to-market strategy that has driven its impressive expansion. At the heart of Figma's customer acquisition strategy is a free tier that removes barriers to entry, allowing individuals and small teams to experience the product's collaborative value without financial commitment. A single user can share a design file via a web link, seamlessly pulling product managers, engineers, marketers, and other stakeholders into the Figma ecosystem, many of whom then create their own accounts.

This organic spread is complemented by a direct sales force focused on enterprise clients. Their objective is not primarily cold outreach but rather to identify and cultivate the large-scale organic usage that has already taken root within major organizations. The evangelism loop—where designer advocacy fuels organic expansion - creates substantial switching costs as Figma becomes central to cross-functional workflows.

Yet this powerful growth engine comes with an analytical challenge that became apparent in our review.

What 2.5% of Customers Reveals - and Hides

One of the most striking findings from our analysis concerned the concentration of Figma's reported metrics. The company's gross retention rate (GRR) of 96% - indicating annual churn of merely 4% - applies exclusively to customers contributing over $10,000 in annual recurring revenue. This certainly establishes that Figma functions as mission-critical infrastructure for these high-value segments.

However, a critical methodological consideration emerges here. The S-1 discloses approximately 450,000 total paid customer accounts, yet these crucial retention metrics apply exclusively to 11,107 customers exceeding $10,000 in ARR. This methodology means metrics justifying premium valuations represent only 2.5% of the paying customer base. While this cohort generates approximately 64% of ARR, the retention dynamics, growth patterns, and health of the remaining 97.5% of customers remain entirely opaque.

The filing also notably omits granular disclosure regarding customers exceeding $1 million in ARR - typically a key indicator of enterprise dominance. The S-1 states only that Figma had "more than 40" such customers as of March 31, 2025, without providing precise figures or growth rates at this critical enterprise level, unlike the detailed breakdowns provided for other segments.

This selective disclosure, while common among product-led growth companies, creates an information asymmetry that should give investors pause. Strong competitive advantages typically manifest across customer segments. The concentration of exceptional metrics within such a narrow band raises questions about the true breadth and depth of Figma's moat.

The AI Adopter Question

Figma's relationship with artificial intelligence comes at a time where AI impact is the object of large scrutiny: companies seen as “AI Adopters” and resilient command a premium to their peers, while others suffer, sometimes largely. Figma undeniably positions itself as an AI adopter. The S-1 mentions AI over 150 times and reveals that 40% of incremental R&D investment went toward AI capabilities last year. The company has developed impressive features - Figma Make for prompt-to-prototype conversion, automated design tools, visual search capabilities, which indeed represent genuine technical achievements.

Yet this substantial investment has yielded no quantifiable revenue (at least that we are provided with). The filing does not break out AI-driven ARR or quantify the revenue impact of these new tools. Core AI features remain in open beta, currently free for users on paid plans. The monetization strategy appears to involve bundling into higher tiers in the future and potentially implementing usage-based pricing, but timelines remain undefined.

More concerning is the tension between AI acceleration and Figma's business model. The company generates revenue through seat-based pricing - charging for individual users. Yet the AI capabilities Figma is developing promise to dramatically increase individual productivity. If AI enables designers, marketers, and developers to become 30% more productive, seat requirements could compress proportionally, effectively shrinking the total addressable market. And the TAM disclosed in the S-1 is one calculated as a result of the company’s commissioning. This is not neutral.

The S-1 acknowledges this risk with unusual directness: "there could be a decrease in the number of designers, developers, and other collaborators that use our platform if such individuals are able to significantly increase their efficiency through the use of AI capabilities." This creates a strategic bind - Figma must invest in AI to remain competitive, yet that same AI threatens to cannibalize its seat-based revenue model.

Despite these concerns, Figma's 132% net dollar retention and 46% year-over-year revenue growth in Q1 2025 suggest near-term resilience. But the absence of AI monetization and the existential questions about the seat model warrant serious consideration when evaluating long-term value. Even if the answer is that i) AI did fuel Figma’s growth and ii) Figma’s business model (and consequently revenue here) will not be impacted by AI (unlikely), I would have wanted more detailed guidelines here.

Architectural Positioning for the Agentic Future

Beyond current financials lies another core question: how will Figma fare as AI agents assume greater responsibility for design and development workflows? Our Architectural Resilience Assessment (a sub-component of the Durable Growth MoatTM framework), performed outside-in and on the sole basis of the S-1 filing and public information, yielded a score of 1.15 out of 2.0 - indicating moderate resilience, sufficient to survive but insufficient to justify premium multiples without demonstrated evolution.

Consider one of the risk components of the matrix, which we term Decision Authority Displacement - essentially, how much of the decision-making that Figma currently empowers humans to do could be automated by AI agents. Figma's value proposition centers on empowering human designers to make creative and strategic decisions. Yet even current AI capabilities systematically automate tactical decisions: layout adjustments, asset selection, component suggestions based on prompts.

As these capabilities expand to design system maintenance, accessibility compliance verification, and developer handoff processes, the scope of human decision-making progressively narrows. The S-1 itself notes that 51% of Figma users working on AI products are developing agentic tools, suggesting rapid evolution toward multi-step process automation.

Strategic creative decisions - aesthetic choices, user experience strategy, brand alignment - remain fundamentally human-centric activities. But the balance between human and AI contribution in design workflows is evolving rapidly, with implications we're only beginning to understand. This evolution could position Figma anywhere on a spectrum from an essential creative platform to a commoditized utility.

Figma shows early recognition of these challenges through initiatives like the Model Context Protocol server for Dev Mode, suggesting ambitions to evolve from tool to orchestrator. However, the platform currently lacks the comprehensive agent infrastructure - dedicated SDKs, persistent memory systems, sophisticated task-routing capabilities - required for true orchestration status. This gap between ambition and architecture represents both risk and opportunity.

The Valuation Reality Check

At its current ~$40bn valuation, Figma trades at approximately 35 times forward revenue based on projected annual revenue of $1.15bn. This multiple places it above all proven enterprise software companies, despite the uncertainties we've identified.

Our pre-IPO framework anchored valuation to elite SaaS peers trading at 13 to 15 times forward revenue. ServiceNow, with deeper enterprise workflow integration and best-in-class financial fundamentals, trades at 14 times. Datadog, demonstrating consistent retention across its entire customer base and proven AI monetization, commands 15 times. In my view, these companies face fewer strategic uncertainties than Figma.

Our analysis yielded a base case valuation range of $15bn to $17bn, with a bull case extending to 18x revenue (~$21bn) contingent on evidence of successful agentic orchestration. The current valuation exceeds even our optimistic scenario.

Traditional valuation theory suggests companies with higher uncertainty should trade at discounts to peers, not premiums. Yet Figma's multiple implies the market believes all uncertainties will resolve favorably - that the hidden 97.5% of customers perform as well as the visible elite, that AI will enhance rather than cannibalize the seat model, and that architectural evolution will proceed smoothly.

Looking Forward

My assessment remains nuanced but clear:

Short-term: The fundamentals are strong enough to justify a premium to average software companies, despite the disclosure gaps. But not at current levels, and certainly not at IPO day euphoria valuations.

Medium-term: The story will shift from growth curves to architectural evolution. Success depends on how deeply Figma embraces agentic AI and positions itself as an orchestrator rather than merely a tool.

Long-term: Without demonstrated AI monetization and architectural transformation, current multiples are unsustainable. The companies that thrive will be those that successfully navigate the transition from empowering human users to orchestrating AI agents.

The contrast with Palantir is instructive. Despite valuations that shock traditional software investors, Palantir has positioned itself as an AI-first company with genuine orchestration capabilities. The network effects derived from its orchestration position, itself the result of an exceptional “context moat”, provide at least partial justification for its premium. Figma has not yet demonstrated comparable positioning.

It will also be fascinating to observe Adobe's competitive response. Despite losing the acquisition opportunity, Adobe retains significant resources and enterprise relationships and has already begun monetizing AI through its Firefly system. The competitive dynamics between these two will shape the design software landscape for years to come.

To be clear, Figma is an exceptional company with a transformative product that has genuinely revolutionized design collaboration. The team has built something remarkable, and the company is likely to continue creating substantial value for users and shareholders. My critique is not of Figma's quality, but of a market that seems to have temporarily suspended fundamental analysis in favor of momentum. Current valuations appear more reflective of technical dynamics and scarcity value in a barren IPO landscape than careful assessment of the uncertainties ahead. When the music stops - and it always does - valuations tend to reconnect with fundamentals. For Figma, that likely means a healthy, successful company trading at a still-premium but more rational multiple.

Our comprehensive 22-page analysis, available to institutional subscribers, includes the full Durable Growth Moat methodology, along with a comprehensive agentic risk assessment across five dimensions. It reveals specific orchestration opportunities and architectural vulnerabilities that will determine whether Figma thrives or merely survives the transition to Software 3.0. Please reach out if you would like to access the research.

Disclaimer: This analysis represents the author's opinions based on publicly available information as of the date of publication. The author and Decoding Discontinuity have no position in Figma securities and no plans to initiate any position within the next 72 hours. This article is for informational purposes only and should not be construed as investment advice. The Durable Growth Moat™ framework is a proprietary analytical tool, and scores are based on the author's interpretation of available data. Readers should conduct their own due diligence and consult with qualified financial advisors before making investment decisions. Market conditions and company fundamentals can change rapidly, potentially affecting the conclusions presented in this article.

.