September by D’Ornano + Co.: Spotting the winners of the foundation model race, Unpacking Alan’s not so crazy $4.5B valuation and exploring Adobe’s GenAI overreaction.

This is our monthly newsletter dedicated to Tech x Investments.

Dear readers,

The recent days have shown that interest in genAI is still at its peak despite the clouds that have emerged in recent weeks. The race for foundation models is still ongoing with OpenAI targeting a 150B$ valuation in its latest fundraising expected to close in the next days. Everyone wants to know which companies will emerge as winners of the new technology, in the same way that Amazon, Paypal, Netflix, and others that emerged from the internet era.

At the foundation model layer, the first layer of the genAI tech stack (beyond hardware & core infrastructure), winners are now starting to appear almost two years after genAI went into the public domain with GPT 3.5. Beyond technical considerations where it is fantastic to see the change and disparities in rankings on performance, efficiency, accuracy, and other criteria used to rank foundation models between closed vs. open-sourced, large vs. small models, and US vs non-US, the speed of adoption at consumer & enterprise levels of the technology now allows for fundamental analysis on assets seen as an index play only just a couple of weeks ago. OpenAI, Anthropic, and Mistral have made substantial advances. I share my views here.

But the race has just started at the application layer, and it will take months, if not years, for winning applications to emerge. Will incumbents take advantage of their large customer base, workflows, financial cushions, and ability to acquire the right start-ups, or native start-ups, on the other hand, building all from scratch? Klarna made quite a stir when it announced that AI could substitute Workday and Salesforce amid GenAI overhaul. Though provocative, it leaves a sense of questioning. It's too early to respond. For sure, valuations of SaaS companies – pressured by an adverse macroeconomic environment – are putting genAI resilience at their core. Technology leaders and investors want to know whether the new technology opens new avenues for growth through price upticks with genAI features and new genAI product sales or if it will antiquate the business. As I have repeated several times in this column, patience is vital. Adobe's recent stock price decline, partly because of lower-than-anticipated growth expectations, appears unfair, as I highlight below. Though the financial impact might take a few more quarters to materialize, the GenAI blueprint should be crystal clear at this point.

I anticipate that the big collapses in the software world are still to come and that no company – even the colossuses of the world – should feel protected. It is time to strengthen existing moats!

But beyond the Tech world, GenAI is changing the game's rules. Material world companies are proving they can stand out through margin improvements by capturing productivity gains. One visible example is Alan, a leading online Insurtech in the health insurance field, which just completed a $193 million round at a valuation of $4.5 billion in a challenging environment for insurtechs. Alan was an early mover in the field and has leveraged it in its core insurance business. Banks and financial companies, and more generally business service companies, are well positioned to capture significant gains from the technology as they improve their ability to service their customers for less in sectors sometimes characterized by razor-thin margins (as for health insurance).

Further into the material world, genAI has already demonstrated solid effects on opex. Per Goldman Sach's Peter Oppenheimer, "It is probable that AI and robotics will not only create new faster-growing innovative companies but also raise the prospect of major restructuring gains in non-technology sectors." Is this a new valuation frontier between those companies able to capture improvements and translate those productivity gains into competitive advantage and the others? More so than a frontier, I refer to this as a cliff. Cherry-picking the winners of the GenAI wave is a high-risk, high-reward game. However, identifying in portfolios those businesses challenged by GenAI and helping them write a new business story around the new technology can reap high returns for private and public market investors. As with the internet, the big winners will be those companies who embrace the technology.

Month after month, week after week, genAI is bringing critical advances. This month, many conversations were about agents – which will open broader productivity gains once they are ready to be deployed – and new reasoning models with the launch of Open AI's strawberry model. There is no doubt that more is to come at a rapid pace. The speed of evolution matches only the speed of obsolescence of companies. We have moved from "Every company is a Tech company" to "Every company is a GenAI" company. Have a great read!

GenAI Foundation Models: The LLM Race Has Only Just Begun, But It Has Its Favorites

The generative AI boom continues and shows no signs of slowing down.

So far, the most significant investments have been in the companies building the foundation models that enable the new technology. The sums have gotten so large and the usage so big that it seems on the surface that the LLM market is mature and dominated by just a handful of names: OpenAI, Anthropic, Meta, Google, Mistral, and Cohere.

Is that conventional wisdom correct? One year after writing about the market for GenAI foundation models, I wanted to revisit the topic and understand what has changed and where we were in the race. Read-on to discover the winners.

Why insurtech Alan’s crazy valuation is not crazy

Insurtech startups have been among the hardest hit during the funding downturn over the past two years. So I understand the surprise when French unicorn Alan recently announced that it had raised a $193m late-stage funding round at a $4.5bn valuation - a nice leap from the €2.7bn valuation of its last round in 2022.

Alan’s round accounts for almost 1 out of every 4 euros invested in Insurtech this year. It appears reasonable to ask: Amid the broader Insurtech carnage, why do these investors have so much faith in Alan?

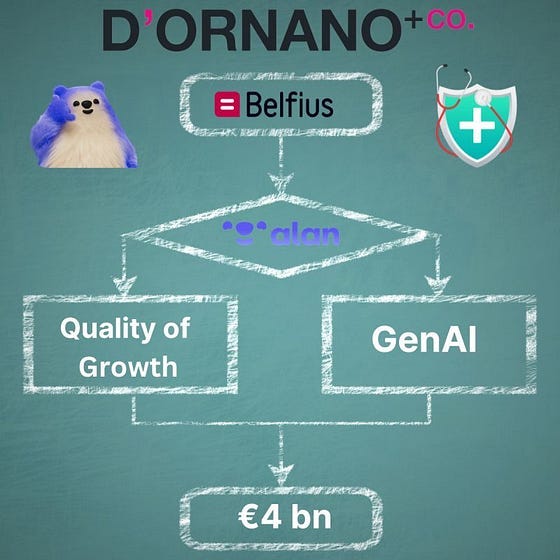

Our firm, D’Ornano + Co, helped gain comfort on the valuation on the deal using the Advanced Growth Intelligence (“AGI”) methodology that we developed specifically to analyze the intrinsic value and resilience of Disruptive Technology companies. While we can’t disclose the proprietary information we used for that analysis, I want to share some thoughts about the deal as founders and investors continue to struggle with the question of valuation.

Adobe’s GenAI Overreaction

Wall Street’s reaction to Adobe's Q3 earnings offers a stark lesson in how investors and executives are struggling to set proper expectations regarding the impact of GenAI. I share some thoughts below, that you will find in this month's edition of my newsletter. Have a great read!

2024 Generative AI Predictions | CB Insights

I am sharing a useful recap on GenAI trends from CB Insights. Through this comprehensive outlook CB Insights explores different trends within the entire GenAI tech stack, with a focus on the latest innovations in the space at infrastructure, model and applications. From AI girlfriends (out) to pocket-sized LLMs (in), where are we headed?

Klarna shuts down Salesforce as service provider, Workday to meet same fate amid AI initiatives | Seeking Alpha

Klarna CEO, Sebastian Siemiatkowski, recently announced in a call with his investors that his company is terminating two of its largest SaaS partnerships, Salesforce and Workday, as part of a complete generative AI overhaul. What is the rationale behind such a decision? Will GenAI native applications replace the incumbents or is this a provocative statement?

Move over copilots: meet the next generation of AI-powered assistants | Financial Times

Beyond copilots, agents are seen as the next frontier on generative AI. GenAI enabled-agents can ease the automation of complex use cases and push the productivity frontier. The FT dives into this trend.

Alan

D’Ornano + Co. advised Belfius in leading Alan $193M Series F round, boosting the company's valuation to $4.5B. Alan is an online digital insurance platform designed to give access to a healthy and productive life, empowering the body and the mind. The company announced earlier this year that its insurance products now cover over 500,000 people, and it expects to reach profitability without the need for another funding round. Some of Alan’s existing investors are participating once again, namely Ontario Teachers' Pension Plan, and Coatue.

Qualifyze

D’Ornano + Co. supported Insight Partners in leading Qualifyze $54M Series B round. Qualifyze is reshaping the pharmaceutical supply chain with streamlined supplier auditing and compliance solutions to ensure the highest standards of safety, quality, and transparency. Since its inception in 2019, the Frankfurt-based platform as secured 150+ global customers such as Merck, Teva, and Cipla, allowing them to monitor and forecast quality and compliance.

Smartcat

D’Ornano + Co. advised Left Lane Capital in leading Smartcat $43M Series C round. Smartcat is redefining translation with a powerful platform that harnesses AI to deliver flawless and rapid multilingual content. The Boston-based platform supports translation in 280 languages, serves over 1,000 clients including 20% of the Fortune 500, and features advanced tools like AI-driven automation, real-time collaboration, and translation memory.

Koltin

D’Ornano + Co. supported Left Lane Capital in leading Mexican insurtech Koltin's Series A. Koltin is revolutionizing healthcare in Mexico by offering the first private health insurance tailored specifically for seniors, combining personalized care and proactive health services with traditional coverage. Koltin aims to fill a crucial gap in Mexico’s insurance market, improving the quality of life for aging populations across the country.

Synovo

D’Ornano + Co. advised Lauxera Capital Partners in its minority investment in Synovo Group. Synovo Group develops innovative software solutions that streamline and optimize medical transport logistics for enhanced patient care and operational efficiency. Founded in 2010, the company employs over 100 people and serves more than 2,000 customers in several European markets.

You like what you've read? Tell and share with your friends!

Newsletter powered by D’Ornano + Co.