Crazier Than Elon’s 6X Tesla Bet: Why Non-Tech Giants Might Be AI’s Real Valuation Dark Horses

How overlooked non-tech titans - over 420 S&P 500 companies and beyond - can harness Agentic AI for transformative gains, and unlock value. New CMU research highlights agentic augmentation potential.

Amid market fears of an AI bubble, the ‘boring’ non-tech firms like manufacturers, healthcare, finance, and entertainment giants stand to capture trillions in value by evolving from AI adopters deploying basic tools to fundamentally transform the economics of their operations with agentic systems. New Carnegie Mellon and Stanford University research validates this potential by showing AI agents complete some realistic workflows 88.3% faster at 90.4-96.2% lower cost than humans. That creates the kind of discontinuity that could yield 6x returns, even if the company isn’t named Tesla. Of course, with caveats.

The AI valuation disconnect could not have been any starker last week.

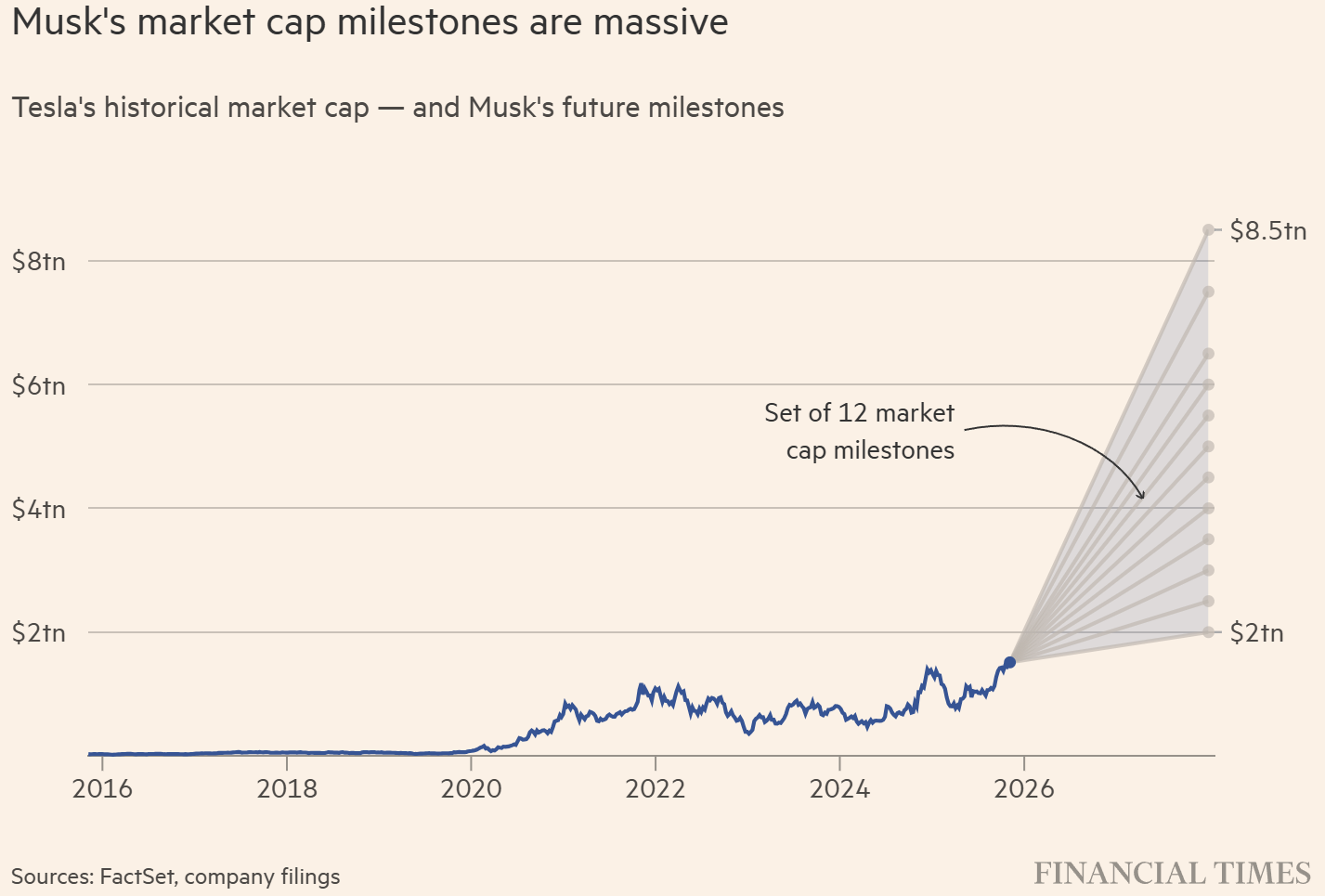

On one side, Tesla shareholders ratified a compensation structure tied to sextupling the company’s valuation over the next decade through aggressive bets on AI, robotics, and automation. More than just a vote of confidence in Musk, it was an endorsement of the exponential economic potential of these technologies to transform a singular tech leader.

On the other side, the Nasdaq remains volatile as it hemorrhages and then adds hundreds of billions in market cap from one day to the next amid AI bubble fears. Analysts questioned whether AI hype had finally peaked. Michael Burry of “The Big Short” fame placed massive bets against technology stocks Nvidia and Palantir. That triggered a war of words with Palantir CEO Alex Karp, but it was also followed by SoftBank’s surprising move to sell its $5.8B stake in Nvidia. Observers pointed to these moves as a verdict that AI’s potential has been overhyped.

What if both narratives miss the real story?

What if the magnitude of value creation possible through AI is just fundamentally misunderstood? What if the companies positioned to capture trillion-dollar returns aren’t the ones Wall Street is watching?

While markets obsess over the tech industry’s frenzied pursuit of AI superiority, they’re overlooking where much of the massive value creation will occur in the transformation of the 423 “non-tech” companies in the S&P 500 that are just starting to tap agentic AI’s potential. These are sectors like health care, energy, logistics, consumer goods, and industry. It’s companies like Caterpillar, Walmart, Pepsico, JPMorganChase, and Disney.

They don’t dominate the headlines and hype when it comes to AI. But a study released last week allows us to begin to grasp the massive scope of the looming value of migration in these sleeping giants.

Research from Carnegie Mellon and Stanford University compares how humans and AI agents complete identical work across data analysis, engineering, computation, writing, and design. These are the actual workflows that constitute modern operations, and the results reveal something material: agents finish tasks 88.3% faster at costs that range from 90.4% to 96.2% lower than those of human professionals, highlighting the potential to enable efficient collaboration by delegating easily programmable tasks to agents.

The question every executive leader and investor should now be asking: What is the estimated economic impact of delegating easily programmable tasks to agents in enterprise workflows?

The Carnegie-Stanford research allows us to start grasping the potential for delegating these “readily programmable” tasks, per the paper’s terminology, that the authors estimate to be 82.5% of the occupation of knowledge work in tech and non-tech companies.

This isn’t a one-time boost. It’s a permanent step-change in earnings power. Multiply this across those 423 non-tech companies on the S&P 500 over a decade, and you are describing the first steps towards one of the largest value creation events in economic history.

As I’ve written extensively, we’re entering the Agentic Era where AI systems don’t merely assist humans but orchestrate entire workflows autonomously. The inference economy emerging from this transformation will allow synthetic colleagues to multiply organizational output without proportional cost increases. I had defined a synthetic colleague to be “distributed networks of specialized agents that share persistent memory, coordinate through structured communication protocols, and pursue decomposed goals under orchestrated supervision”.

Of course, not all companies have the potential to 6X their valuations (perhaps not even Tesla!). There are many layers within this big slice of the S&P 500 cake. A company that makes heavy machinery will still be bound by different physical constraints than a bank, but can benefit from the value creation in the same way, turning those same physical assets into foundations for their moat in an agentic world.

So, let’s refine this question: How do other companies think about multiplying their value by 2X or 3X? I’ll break that answer down into three parts:

The Margin Expansion Mathematics

The Revenue Multiplier

Timeline (aka, patience!)

Given the swirling debates over AI hype and bubbles, the temptation is to sit on the sidelines and see how it all plays out. Whether you are an investor or executive, that is a recipe for missing what may prove to be one of the century’s most asymmetric investment opportunities.

Below, I try to provide guidelines on where I think “pockets” of value exist, and what they entail.

Margin Expansion Mathematics

The cost structure implications require careful analysis. As the research indicates, not all work is equally amenable to agentic replacement.

If we analyze the 11 official categories of the S&P 500, the 423 “non-tech” companies are found in Materials, Real Estate, Utilities, Energy, Consumer Staples, Health Care, Industrials, Communications Services, Consumer, and Financials (with some exceptions in the last four). Whatever the core business, to some degree, each of these businesses relies heavily on knowledge work to operate.

The Carnegie-Stanford research identifies three categories of programmability that determine cost compression potential:

Readily programmable work includes deterministic tasks solvable through code execution: data analysis, system configuration, computational tasks, and structured writing. These tasks are estimated to represent between 20% and up to 50% of total tasks. For this category, agents achieve the cost reductions stated supra. The workflows are redesigned entirely around programmatic approaches, with humans in the loop and agents completing, under human supervision, these programmatic tasks. This applies, as suggested in the paper, to both tech and non-tech environments.

Partially programmable work includes tasks theoretically amenable to code but requiring workflow redesign or human judgment at key decision points: complex engineering design, strategic planning, content creation, and operational optimization.

Minimally programmable work includes tasks requiring visual perception, aesthetic judgment, or contextual understanding where current agents struggle, such as relationship management, negotiation, strategic oversight, and quality assessment requiring domain expertise. For this category and the latter, we take the hypothesis that, given the state of agentic AI, agentic replacement of human workflows is not yet possible.

Now let’s apply the Carnegie-Stanford programmability categories to JPMorganChase.

The finance giant has about 317,000 employees and about $96B in annual non-interest expenses, based on extrapolation of Q3 25 figures. We can estimate this to include $48B in labor costs, i.e., 50%, using average banking & finance labor ratios.

According to the Carnegie-Stanford research, programming is required in 82.5% of relevant occupations. So, we would want to analyze the tasks that fall within about $39.6B of that labor.

(Note: While the research estimates that programming skills are required in 82.5% of occupations (based on U.S. Department of Labor ONET data), this figure reflects broad occupational requirements rather than the precise proportion of daily tasks that are readily programmable or automatable by current AI agents)

Assuming that 30% of tasks are readily programmable (e.g., data analysis, risk computations), this indicates about $11.9B could be redirected to agents. In an optimistic scenario, the agents then achieve cost savings close to c.93% or about $11.1B.

Taking $11B in gains as a base case (per the above), JPMorgan’s net profit margins could expand from 32% to 38% based on $ $180.6 billion revenue in 2024. (Note: for calculation purposes, JPM reported 2024 net income was $58.5 billion on $180.6 billion revenue, which implies net margin ~32.4%).

Of course, that implementation is not just about labor reductions. It allows for the reallocation of human time. In a recent interview with CNN, JPMorgan CEO Jamie Dimon played down the impact of AI, saying: “We always redeploy” employees and that “there will be jobs eliminated by AI... [but] it will also create jobs.”

But I think he is underestimating the true financial impact of agent-related savings. I believe the 6% margin gain calculated supra., well ~50% of that would ultimately be a net gain in JPMorgan’s P&L, leaving us with 3% margin improvement in our example.

As agentic AI development allows us to apply the same reasoning for “half-programmable” and “less programmable” tasks, the productivity gains will augment, though this is conditional on technological progress.

The study, however, explicitly notes that while agents are blazing fast and cheap, they often fabricate data, hallucinate outputs, or fail on nuanced tasks requiring judgment. This leads to “significant quality gaps” in results. This means that real-world deployments could introduce “silent risks,” like erroneous financial models at JPMorgan or flawed engineering designs at Caterpillar. As the research notes, current agents “fail harder” when they go wrong, potentially eroding trust and slowing adoption.

Nonetheless, the math remains valid. And it’s why the authors highlight the effectiveness of the human-agentic collaboration.

As I explored in the agentic era series, this human-agent teaming represents a new organizational model where humans function as orchestrators rather than executors. The margin expansion isn’t achieved through headcount reduction per se, though part of it will be, but through materially higher productivity per employee that drops directly to operating profit.

Beyond labor impact, agentic AI has the potential to further reduce OpEx through cost reductions linked to more efficient operations as a result of agentic AI in production across core business domains.

The Revenue Multiplier

Cost compression, however dramatic, remains inherently limited. You can collapse costs once. There is only so much share of personnel costs on the P&L or efficiencies to gain.

Inevitably, real exponential gains must come from exploding revenue opportunities. This is certainly what persuaded the Tesla board to approve the $1 trillion pay package. In the broadest sense, it is a massive bet that a single company run by a single man has a unique opportunity to invent the future.

Though there are plenty of gaps in the roadmap, in Tesla’s case, these are at least some clues as to how the company thinks it can 6X its valuation.

Musk’s controversial pay package is broken down into 12 tranches that he receives in stages if the company hits ambitious market cap goals as high as $8.5 trillion from its current $1.46 trillion.

But in terms of operations, the board also adopted some very specific goals for Musk:

Increase annual adjusted profit from $50 billion to $400 billion.

Deliver 20 million vehicles, up from the current 8 million.

Sell 10 million active FSD (Full Self-Driving) subscriptions, up from the current number, which is unknown.

Deliver 1 million Optimus humanoid robots, up from 0.

Deploy 1 million robotaxis in commercial operations, up from a handful.

Certainly, for those 423 non-tech S&P companies we identified, such products are nowhere on the horizon. But in the Agentic Era, the potential for exponential revenue will still emerge as agents remove fundamental constraints on what can be sold and how value scales.

There are two distinct mechanisms driving revenue multiplication in the agentic era:

First, orchestration monetization occurs when companies redesign their workflows around agentic AI to capture the customer’s pain and solve it, yielding revenue that consists of a share of that outcome.

For example, today Caterpillar manufactures construction equipment. But tomorrow, the real value isn’t selling excavators. The value migrates to optimizing how construction happens.

When agentic systems continuously coordinate every piece of equipment on a job site in real-time, adjusting operations based on weather, ground conditions, and resource availability, then Caterpillar isn’t just selling machines. It’s selling construction orchestration as a service. The hardware becomes nodes in an intelligent network, generating recurring revenue from the coordination layer. This creates a new revenue layer that is potentially far larger and far more profitable than its historic business.

Orchestration revenue emerges when companies shift value from one-time sales to recurring, scalable services by layering intelligence on top of existing assets. Which, naturally, requires that they have these actual assets.

The economics transform completely.

The question then becomes: What is the nature of the “Orchestration revenue” model?

As I detailed in the inference economy analysis:

“as agentic colleagues perform cognitive work, enterprises will pay for tasks and outcomes rather than software licenses. This creates ‘orchestration revenue’ priced at multiples of underlying inference costs, with those compute costs flowing directly back to infrastructure providers. Every completed workflow generates billable compute consumption that cascades through the value chain to hyperscalers and chip manufacturers. This produces gross margins of ~60-90% for orchestration platforms, while simultaneously generating the predictable, high-margin infrastructure revenue needed to justify today’s build-out.”

Second, there is the innovation unleashed by products and services created that were not possible before. For Tesla, this will be the robotaxis, Optimus, and FSD. But when (or if?) these are ever deployed at scale, what other products and services could Tesla then provide on top of them?

During the Tesla shareholders meeting, as Musk spoke, he began riffing on various subjects, as he often does. And at one point, he suggested to the audience that if the company could deploy Optimus at scale, it could replace the entire American penal system. Instead of putting a criminal in prison, perhaps it would be more humane to have an Optimus follow them to ensure they don’t commit another crime.

Was he serious? Or just expressing random, unfiltered thoughts? Probably the latter. But either way, it suggests a certain mindset (even if also a bit chilling): His view of the company’s valuation is not narrowly defined by a single direct market, but he’s always trying to imagine the exponential opportunities an innovation unlocks.

From EV manufacturer to disrupting the $81 billion American incarceration system? It’s not a business vertical that would have been on most car company CEO’s roadmaps. (And again, to be clear, it has a likelihood of close to zero.)

The Compounders Emerge

Combine an estimated 5+ point margin expansion with revenue multiplication through orchestration and constraint removal (i.e., innovation), and we now have a new mental model for how we think about value.

The quality transformation here matters as much as the magnitude. Agent-orchestrated operations are more predictable than human-coordinated workflows. Revenue becomes more forecastable because intelligent systems identify and resolve issues before they cascade. Cash generation improves because agents naturally optimize for capital efficiency, rather than requiring humans to pursue it explicitly.

Most crucially, businesses become more defensible. Orchestration layers trained on proprietary operational data create switching costs that traditional products never achieved.

A customer using your construction optimization agents hasn’t just bought equipment. They’ve integrated your intelligence into their operations. Replacing your hardware might cost hundreds of thousands. Replacing your orchestration intelligence that runs their entire site costs millions in lost operational efficiency during transition.

The moat deepens.

The path to 6x returns becomes clearer:

Operational transformation with 3-5+ points margins

Revenue growth acceleration through new intelligence products (growing theoretically faster than core revenue)

Multiple expansion from improved quality

The multiplication compounds create X (2, 3, 6?) value through complete business model transformation.

This transformation won’t manifest linearly or quickly. Companies must redesign workflows around what agents do well rather than forcing agents to mimic human processes.

The hard work spans years:

Identifying which workflows are readily programmable and can be delegated to agents

Redesigning partially programmable work for human-agent teaming

Developing orchestration products that monetize operational intelligence

Reimagining offerings becomes possible when constraints vanish

Considering the right way to approach this for the people impacted. Perhaps this is reskilling? Transferring into new orchestration entities? Many questions remain and will need to be addressed.

Although the technology is not fully mature, I am convinced this change is coming.

Near-term results will look messy as companies invest in transformation and experiment with new revenue models. Operating margins may initially compress as restructuring costs are recognized in the income statement. New product launches will show mixed results as companies learn which orchestration services customers actually value.

The market will likely punish this uncertainty. Wall Street wants clean AI narratives. That means either enablers selling infrastructure or adopters showing immediate ROI from tools.

The current market panic reflects this narrative confusion. Investors see two categories: AI enablers like NVIDIA riding capital expenditure cycles, or AI adopters deploying chatbots and issuing press releases. Neither category justifies current valuations if AI proves incrementally rather than transformationally valuable.

Hence, the bubble fears. The Burry bets. The market volatility.

Yet, a third category is emerging that neither narrative captures: AI compounders restructuring operations to capture both margin expansion and exponential revenue growth. This is the thesis we have articulated above and that we believe in.

The AI compounders will capture a very large share of value creation in the agentic era. Not through hype or hope, but through operational transformation grounded in the quality of their existing moats (notably physical-digital presence, regulatory constraints, consumer brand and loyalty, etc.). The question is whether management has the conviction to pursue transformation while Wall Street demands conventional narratives and punishes complexity.

The margin opportunity alone justifies the transformation. Add orchestration revenue and business innovation, and you’re not improving quarterly performance. You’re rebuilding the business for a different economic regime.

The hard work spans years: identifying which workflows are readily programmable and can be delegated to agents, redesigning partially programmable work for human-agent teaming, developing orchestration products that monetize operational intelligence, and reimagining offerings possible when constraints vanish.

Although I have laid out this theory and the potential, we must still recognize operational reality. This transformation will play out over many years. These companies won’t announce grand AI strategies in earnings calls. They’ll quietly spend two to three years re-architecting core operations, integrating agents, retiring interface-based workflows, and redeploying human talent to orchestration roles.

But the signs are there. We can already see the companies that have started the journey through their roadmaps, the trail of breadcrumbs they leave on LinkedIn, and a host of indices that signal whether a company is on the right path without waiting a decade or more to know. Not everyone is flying blind. There are proof points that we can examine that are not just about numbers.

For the companies doing this right, these early steps will put them in a position to establish new high-margin revenue streams scaling to billions and creating business models fundamentally more defensible.

Eventually, those exponential gains will burst into public view. Wall Street will call it an overnight success. It won’t be. It will be the result of taking action and moving forward despite uncertainty to start putting in place the long-term plan for the agentic AI era.

In my view, patient capital will be well rewarded. The skepticism, in retrospect, might prove very expensive.